Decision Intelligence Frameworks

(a quick, pragmatic guide for people who actually have to make high-stakes R&D decisions)

I’ve written before about the decision risk in having one decision methodology for all phase I assets. While there is inevitable risk in pharma’s phase I decisions, there is zero attributed risk to the decision process - that is, 100% faith in it being the perfect/ best decision process, with no other processes considered.

“Uniform quantitative criteria are anti-innovation…” Requiring the same pSuccess and NPV bar for a $2B one-time gene therapy as for a $400M peak-sales oral forces you to either (a) torture the model or (b) kill genuinely transformative programs.

In reality, early-phase pharma decision-making is anything but uniform.

A first-in-human (FIH) dose-escalation call for a small-molecule cytotoxic isn’t governed by the same risk tolerance, evidentiary bar, or stakeholder dynamics as, say, a phase I/II CAR-T or an AAV gene therapy with potential lifelong effects.

Yet many companies do pretend (or aspire) to have “one decision-making process” for all phase I go/no-go decisions, usually some variation of Target Product Profile (TPP) + Probability of Technical Success (PTS) + net present value (NPV) cutoffs. (Yes, I’ve written many times about the McK-like nonsense of TPPs and eNPVs…)

Here’s how the “One Process to Rule Them All” usually looks in real life, and why it quietly fails in practice:

The Standard Corporate Template (the fiction)

Preclinical package → Human Dose Projection (MABEL/PAD/MRD)

TPP defined (almost always too optimistic)

Quantitative decision criteria

Go if predicted human dose < X mg (or < Y µg/kg for biologics)

Go if eNPV > $500M and pSuccess > 15–20 %

Go if competitive intensity score < 4/10

Governance: Portfolio Review Committee votes by coloured cards (green/yellow/red) after a 45-minute deck review.

Where it cracks immediately

Cytotoxic oncology (2025 version)

You’ll tolerate 10⁻⁴ risk of death in phase I because the patients are end-stage and the bar is response rate > 20 %. Your MTD-finding 3+3 design is fine.Intra-thecal antibody or brain-penetrant small molecule for Alzheimer’s

Same process, same committee, same NPV cutoff. But now a single serious neuro adverse event in a 68-year-old with prodromal AD kills the program politically, even if it’s not dose-limiting by protocol. The risk tolerance is 100× lower.One-time curative gene therapy (e.g., hemgenix-like price aspirations)

You need 15-year durability projections from 9-month mouse data. Your pSuccess is a coin flip dressed up in Bayesian clothing, but the same 20 % hurdle is applied as if it were another oral TYK2 inhibitor.Radiopharmaceutical with alpha emitter

The dosimetry models have 5× uncertainty, the therapeutic window is a knife-edge, but the deck still has to show “projected dose < 2 Gy to kidneys” with a straight face.

The unspoken two-track reality (that everyone knows, but few admit)

Track A – “Franchise oncology and rare oncology”

Decision = “Do we think it can kill tumor cells without killing the patient too fast?”

Everything else is theater.

Track B – Everything else (CNS, chronic non-oncology, gene therapy, pediatric, etc.)

Decision = “Can we convince ourselves and regulators that the risk of a catastrophic safety event in phase I is < 1 in 10,000?”

NPV is a tiebreaker only after safety concern is satisfied.

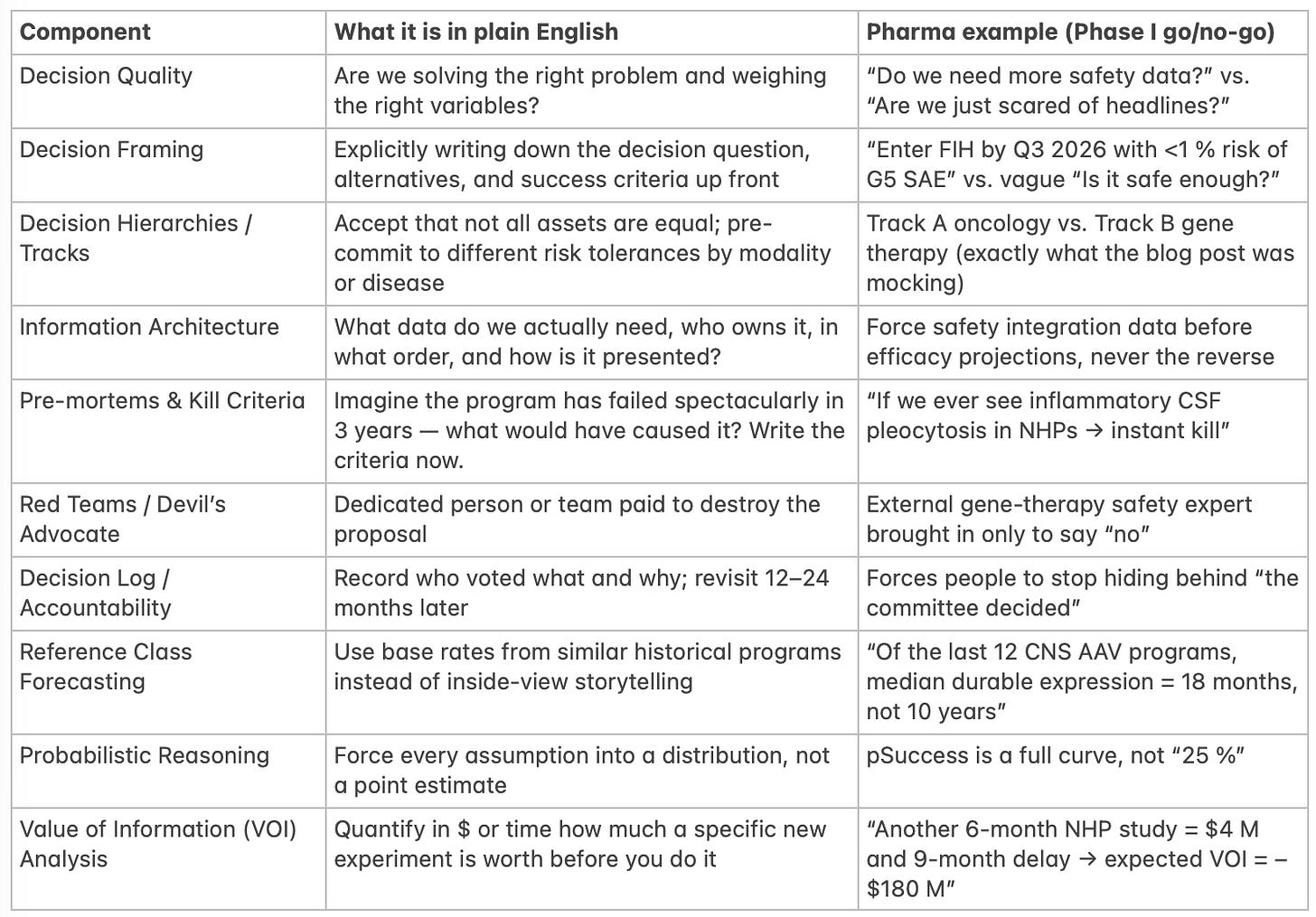

Decision Intelligence is the disciplined practice of combining three things that are normally kept in separate silos:

Analytical rigour (data, models, probabilities)

Behavioural awareness (how humans actually decide under uncertainty, politics, career risk)

Process design (how you structure meetings, information flow, and accountability so the first two don’t get mushed together)

Decision Intelligence originated in tech/ data-science circles (Google, BCG Gamma, etc.), but it maps perfectly onto early-phase pharma portfolio decisions.

Core Components of Any Serious Decision Intelligence Framework

*NHP = Non-Human Primate…

Frameworks People Actually Use in Pharma / Biotech (2025 edition)

(Caveat - these are public frameworks, not something I’ve seen in confidence…)

RAVE™ (Genentech/Roche)

Risk, Alignment, Value, Executability – scored 1–9 with forced distribution. Explicitly separates “strategic fit” from pure NPV.DICE (Pfizer)

Decision-making In Complex Environments – heavy on pre-mortems, reference-class base rates, and mandatory decision logs.Kepner-Tregoe (old but still alive at GSK, Sanofi)

Very structured: Is/Is-Not analysis, decision matrix, potential problem analysis.McKinsey Decision Tree / Issue Tree approach

Brutally forces MECE framing and explicit tracks.Bayer’s “Decision Boards” + “Kill Early, Kill Often” mantra

Two-stage: technical feasibility board first (scientists only), then commercial board.Asymmetric / Two-Track Model (what the blog post is really advocating)

Stop pretending; just admit you run oncology like a different company from gene therapy.

The One-Page Decision Intelligence Checklist I’d Give to Portfolio Teams

Before you walk into any phase I governance meeting, can you answer YES to all of these?

Decision question written in one sentence

Explicit success criteria and kill criteria written down

Risk tolerance track declared (Track A/B/C…)

Base-rate reference class presented (what actually happened to the last 10 similar programs)

Pre-mortem completed and mitigations listed

Value of perfect information calculated for any proposed new studies

Someone in the room is formally assigned to argue the opposite case

Decision and rationale will be logged and revisited in 18 months

If you can’t tick every box, you are not making an intelligent decision. You’re just performing one with better PowerPoint.

That’s what decision intelligence actually looks like when you strip away the consulting jargon: ruthless honesty about risk asymmetry, enforced base rates, and a process that makes it hard to hide behind spreadsheets.

A Final Note on Decision Risk vs. Decision Intelligence

The single-process illusion doesn’t just hide safety risk; it quietly strangles ambition.

When every program is forced through the same NPV ≥ $500 M and pTS ≥ 18 % filter, the easiest way to pass is to shrink the vision until it fits.

A potentially curative AAV gene therapy for a blinding disease gets re-framed as “visuomotor improvement by +12 letters at year 2” because that’s what the model recognises as “realistic.”

A brain-penetrant degrader that could actually modify Alzheimer’s is re-scoped to “mild cognitive impairment, adjunct to donepezil” because disease-modification is apparently unmodellable and therefore worth zero in the spreadsheet.

The universal framework is quietly optimised for the median oncology small molecule, not the outlier that might actually change medicine. It rewards predictable mediocrity and punishes asymmetric upside.

True decision intelligence does the reverse: it forces you to ask, out loud, “What would have to be true for this to be a ten-billion-dollar, decade-defining medicine?” and then designs the experiments and risk tolerances around that ambition instead of trimming the ambition to match the experiments you already have.

Until we are willing to say “This program is allowed to have a 9 % technical success probability because the efficacy, if it hits, rewrites the specialty,” we are not allocating capital intelligently.

We are just safety-washing incrementalism in the clothing of rigour.

Green doesn’t always mean go. Sometimes it just means “safe enough to be average.”

I’ve argued before that pharma might, if it wants to de-risk early phase decisions, at least try a second process - even on 10% of the portfolio. The decision not to is an active decision…

Until we are willing to say out loud “this process that we, and most other companies, use is not, and never has been, fit for the early phase portfolio,” we are not making decisions. We are performing them.