Gradually, then suddenly

Beating the status quo bias: shifting pharma from the wrong decision process to a better one...

I was musing on something when the lyrics from Foo Fighters’ Everlong prompted a thought:

The only thing I’ll ever ask of you

You’ve got to promise not to stop when I say when

While this could perhaps apply to many CEOs of biotechs briefing their Heads of R&D, it sums up the inertia in changing large pharma portfolios to a better decision process in Phase I. Most companies are never planning to stop, even though the world is saying ‘when’.

Picture the supertanker of Big Pharma: gliding through regulatory seas, its momentum so immense that even spotting an iceberg ahead feels like a distant whisper. Large pharma has more opportunity to embrace change in Phase I - where optionality reigns and failures are cheap - yet they’re currently getting it wrong more often than right, with R&D productivity flatlining for over a decade. It’s like the frog in the pot: the water heats gradually, and by the time the crisis boils over, it’s too late to leap.

“How did you go bankrupt?” “Two ways. Gradually, then suddenly.” Ernest Hemingway, The Sun Also Rises

“All deaths are sudden, no matter how gradual the dying may be.” Michael McDowell

There’s always been a belief that pharma is in a productivity crisis - and 2025 data only sharpens the view. Since 1950, the number of new drugs approved per $1 billion in R&D has halved roughly every nine years, a $20 billion annual black hole that’s stunning even for an industry accustomed to billion-dollar bets. (You probably know how big a fan I am of Jack Scannell’s work .) Big Pharma’s innovation engine is sputtering, with declining R&D efficiency, skyrocketing costs exceeding $3.5 billion per novel drug, and a patent cliff looming larger than ever - threatening the traditional giants. But the McKinsey-type solutions? They’re like prescribing aspirin for a heart attack - targeting symptoms while ignoring the arrhythmia. I’m not alone in this critique; it bubbles up in tech, consulting, and even pharma circles, often pinning the blame on Goodhart’s Law: “When a measure becomes a target, it ceases to be a good measure.” In pharma, this manifests starkly: both GPs and drugmakers chase surrogate markers like HbA1c or cholesterol levels to hit targets, sidelining the real endpoint - patient survival - turning metrics into a game of regulatory Whac-A-Mole.

Take the McKinsey Developer Velocity framework, repackaged for pharma R&D: it fixates on “effort or output” proxies like story points or inner-loop cycle times, whispering “coders need to code” (or in our world, “chemists need to synthesize”). This undervalues the messy magic of collaborative transitions - design handoffs from Phase 0 to I, or exploratory data dives that could kill a dud molecule early.

From engineering backlash bleeding into life sciences, the verdict is clear: “The McKinsey framework only measures effort or output, not outcomes and impact,” fostering silos that drag molecules along zombie paths, alive too long and far from market viability. It’s the cobra effect in a lab coat: incentivize speed in early phases, and you breed a pipeline bloated with low-quality candidates, inflating attrition rates that already hover at 90%.

Optimizing for phase transitions alone? That’s the wrong rudder on the supertanker - solving the wrong problem by keeping flawed assets afloat, echoing how airlines clung to legacy booking systems in the ‘90s, measuring ticket sales per agent while ignoring the digital revolution that birthed Expedia and gutted their margins. Or consider Blockbuster’s infamous inertia: they measured store foot traffic and late fees, blind to Netflix’s streaming pivot, until the “gradual” decline hit “sudden” bankruptcy.

In pharma, this manifests as over-reliance on rigid go/no-go gates, where the “go” bias - fueled by sunk-cost fallacies - prolongs the agony, much like Detroit’s car makers optimizing for horsepower or luxury in gas-guzzlers while Tesla quietly electrified the road.

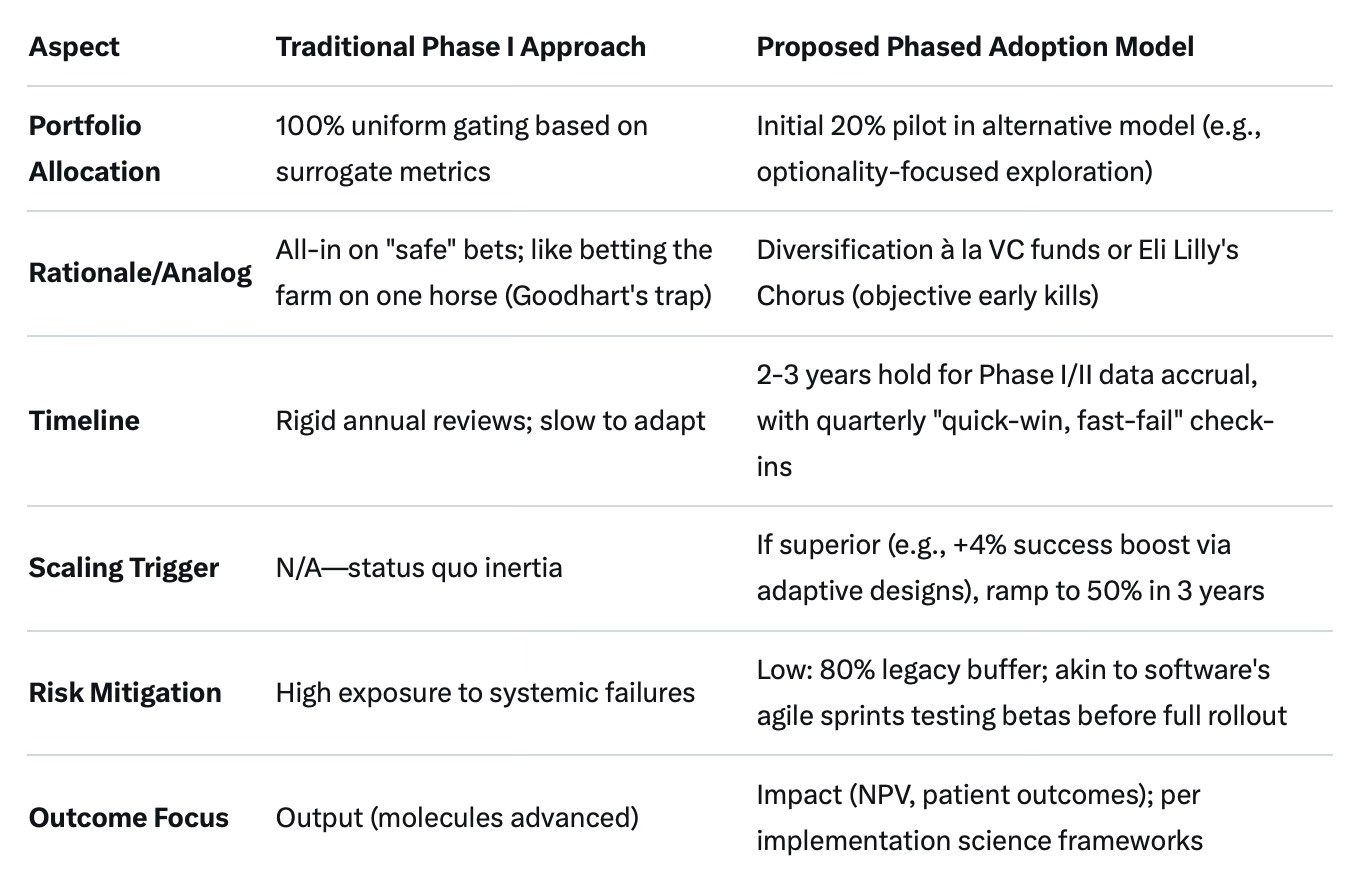

We all mostly know (especially folks who follow this blog) that we need to change our approach. I’m a believer in our model that explores and exploits optionality in early Phase I - treating it not as a linear funnel but a branching delta of possibilities (asymmetric learning), where real options valuation (inspired by financial derivatives) lets you prune losers early and double down on winners with data, not dogma. But shifting decision processes overnight? That’s like rewiring a nuclear submarine mid-dive - risky and rare. So, we modeled a gentler approach: start small, learn fast, scale smart. Think of it as venture capital’s portfolio theory applied to pharma: in high-risk oncology (1-in-5 success odds), VCs spread bets across 10-20 startups to hedge the busts; pharma can do the same with molecules, with optionality instead of fingers-crossed bets.

Initially, allocate 20% of the Phase I portfolio to the alternative model, drawing from diversification strategies in high-risk areas like oncology where a 1-in-5 success rate demands spreading bets across multiple candidates to mitigate failure risks. This isn’t blind faith - it’s a controlled experiment, echoing how AstraZeneca’s 5R framework or Eli Lilly’s Chorus model uses objective early-stage assessments to cull the weak without mercy. (I believe it’s now 6Rs…) The percentage allows meaningful piloting without overexposing the overall portfolio, enabling data collection on the model’s performance in real-world Phase I/II settings while maintaining traditional approaches for the majority - much like how banks post-2008 stress-tested 20% of assets under new regulations before full Basel III adoption, avoiding a Lehman-style implosion.

Maintain this initial allocation for 2-3 years, aligning with typical Phase I/II timelines and allowing time for interim reviews (e.g., quarterly or semi-annually) to evaluate outcomes like success rates, costs, and timelines before scaling up or adjusting. This period supports a “quick-win, fast-fail” framework to terminate underperforming projects early and inform broader adoption - imagine it as evolutionary economics in action: let the fittest decisions survive, just as biotech’s “fail fast” ethos, or its sheer diversity and Darwinian evolution, has outpaced Big Pharma’s plodding pace over the last decade.

If (when) the model proves superior (e.g., via higher success rates or reduced costs, as seen in adaptive trial adoptions that can boost probabilities by 4 percentage points), transition more of the portfolio progressively over the following 3-5 years, akin to the gradual scaling of emerging biotech models or Pharma 4.0 pilots that embed digital handoffs enterprise-wide without ripping out the old plumbing overnight.

In the end, this isn’t just about tweaking gates - it’s about reorienting the compass from “more molecules” to “better medicines,” and therefore better commercial returns. As Hemingway might quip, the bankruptcy of stale R&D isn’t inevitable; it’s a choice. Promise not to stop when I say when? Better to start turning the wheel now, before the sudden hits. Why would pharma not be ready to pilot 20%, versus still warming the frog’s pot?