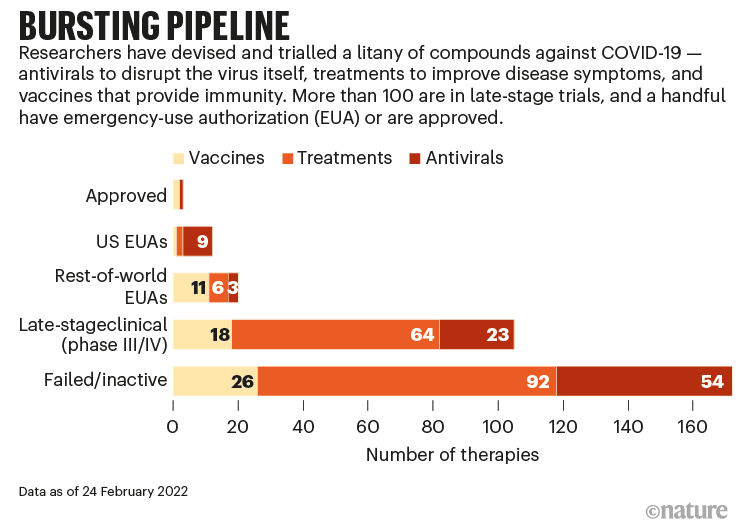

If you assembled 100 incredible medical brains, and showed them 100 drug candidates for one disease, how many of their picks do you think would be successful? It is an exercise run (with slight changes in parameters) on most days in pharma. It was also an exercise run by NIH/ CDC against Covid-19, with a view to repurposing drugs against that new critical target. The success rate? Almost nil.

And, let’s remember, although Covid-19 is relatively new, its family isn’t. And the drugs were mostly not new, but ‘working’ elsewhere. So, this is about as easy as it gets in pharma.

So, two thoughts. Do you:

make it 101 brains, and 101 candidates, then 102…, or

rethink how you’re going about it?

Pharma is mostly based on the former. It is, today, a business of picking winners. Typically not quite as overtly as Novartis, with its recent announcement that it will “prioritize ‘high-value’ multibillion dollar assets”, but the TPP process itself, the ‘prediction paradigm’, that requires early stage assets to carry forecasts way beyond the capability of any brain or organisation to produce.

No-one in pharma has the ability to pick winners. People or companies that are serially successful have been so because of their process - identifying winners by training them, rather than spotting them.

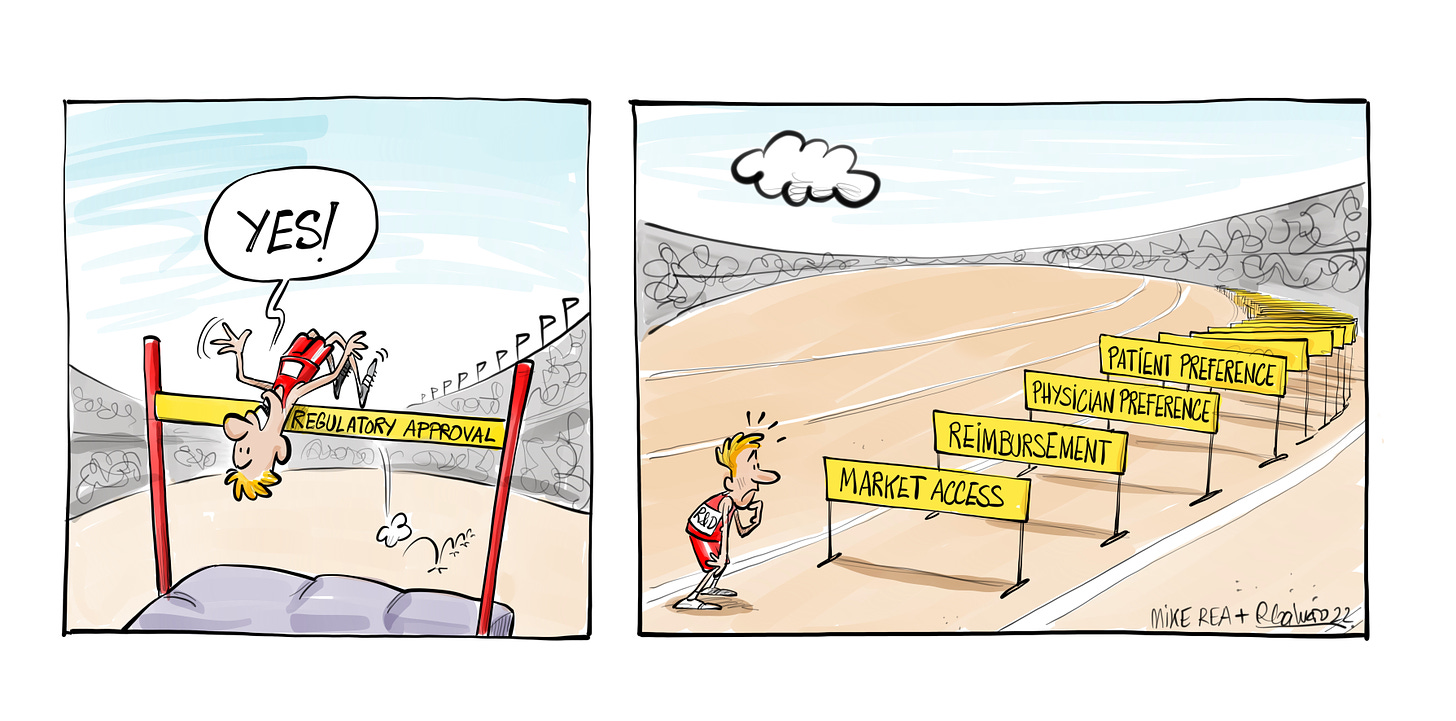

Here’s why: even if you could pick a great candidate for a disease, you would also have to be able to ‘see’ its path through regulatory, and its place in the commercial landscape (a task that the aforementioned Taskforce to repurpose for Covid could ignore). Each of those is a variable, not fixed.

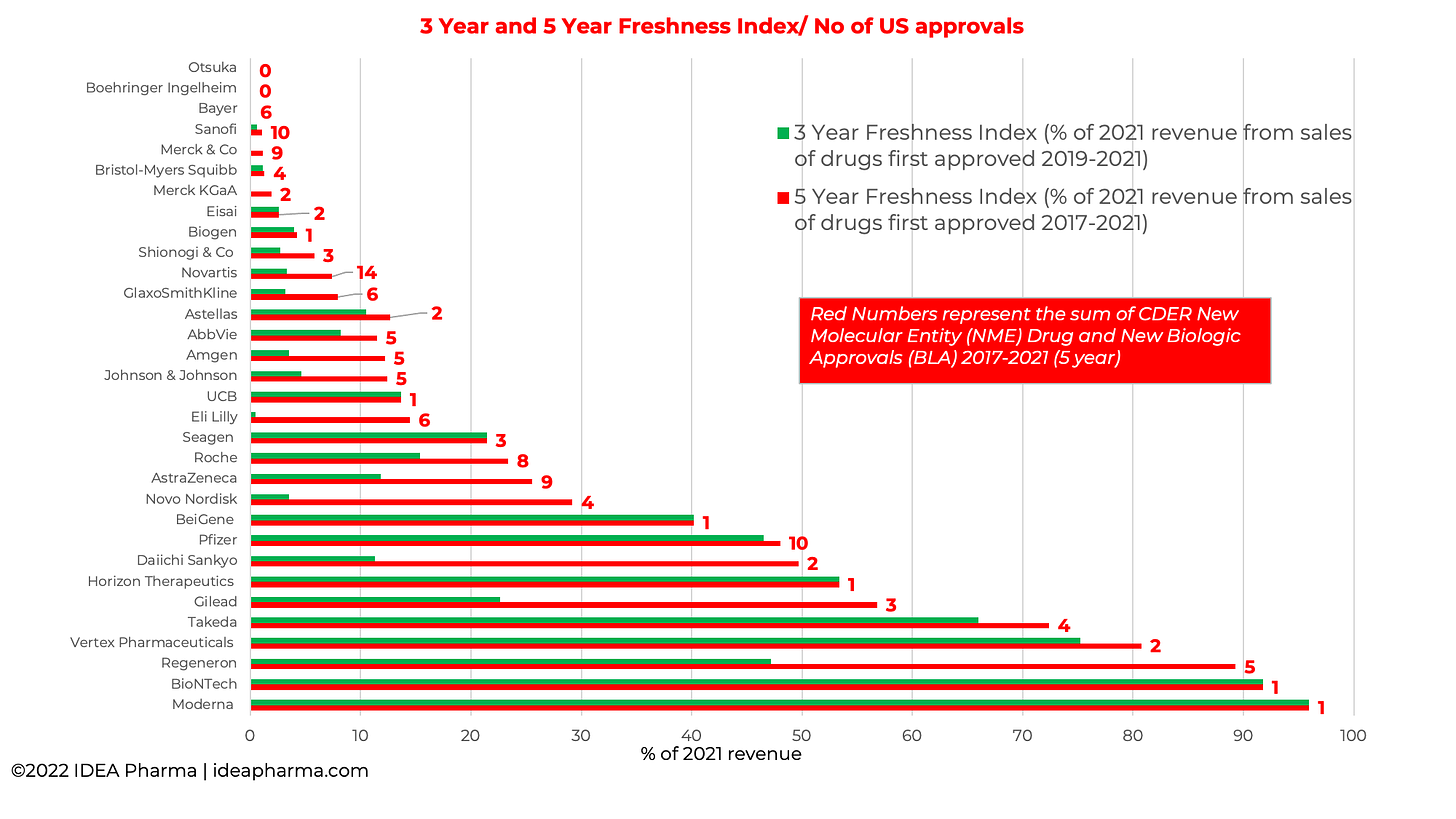

Pharma does do two out of three, more often than it does three out of three. However, far from ‘2 out of 3 ain’t bad’, some companies are launching a lot that is not paying back. Look at this snapshot of 2021 revenue, and how much came from new drugs launched in the past 5 years, together with the number of US approvals each company has had in the past 5 years. It’s hard if you don’t have any new approvals, of course, but if you’d had upwards of 9 or 10, would you have expected them to be contributing by now? That is a rate that is above the industry average for approvals. The past 5 years have seen companies create new records for numbers of approvals in any one year. But those products often aren’t meeting a market need, despite market need being more ‘predictable’ than biology.

For CDC/ NIH, a ‘winner’ was a drug that would work. A hard enough ask. For a pharma company, a winner has to do more than that - it has to be better than the competition, and worth the money.

Like poker, the way to win serially is to use the early rounds to learn, not to just test if you were ‘right’ - no amount of smarts or information will enable you to pick a winner at the beginning. Clearly in some fields, there are people who are better at picking winners than others - horse racing, for example. But despite ‘winning’ being a relatively easy thing to define in horse racing, there’s a lot of judgements in there:

Here are the factors to take into consideration when trying to select a winning horse:

Horse Form

Going

Distance

Breeding and Pedigree

Age

Connections

Days Since Last Race

Course Form

Handicap Mark or Rating

Paddock

Betting

Winning by the time the game ends is a process, a discipline. Early phase needs a different approach, not just new (or old) people.

Here’s the kicker: should another pandemic occur, do we think that the exercise above would be run differently, or the same but with 101, or 102 of the great and good? If we want a different outcome, we should at least be thinking of a parallel process. So should pharma.