“The best time to plant a tree was 20 years ago. The second best time is now.”

I had to attribute this while writing this post, so I dived a little deeper…

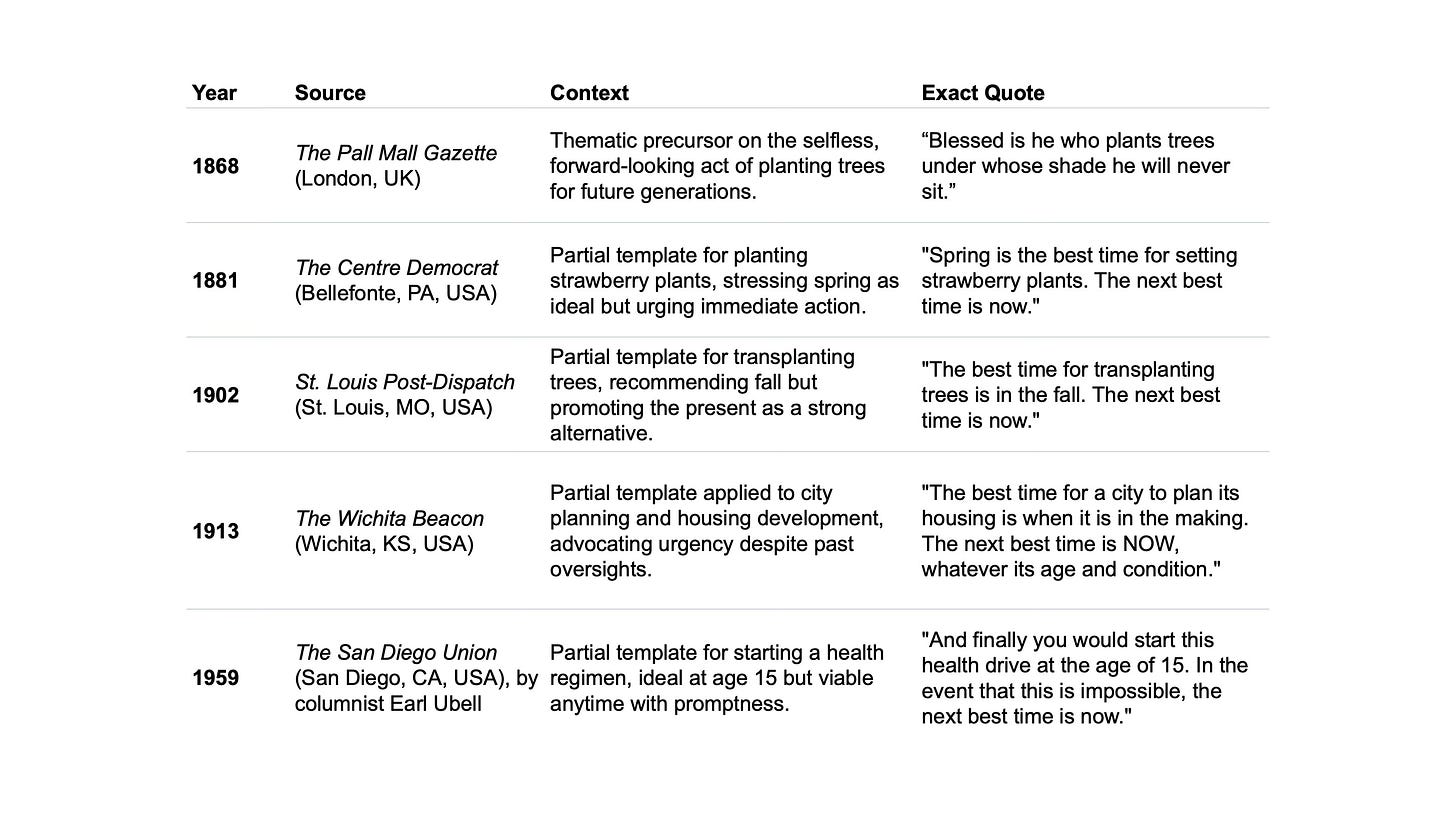

The creator of the adage remains anonymous. Its earliest strong match in print appeared in The Cleveland Plain Dealer (Ohio) on March 19, 1967, in a speech by local city councilman George W. White. He used it to advocate for urban renewal: “Someone remarked that the best time to plant a tree was 30 years ago, and the second best time to plant a tree is now. That’s how it is with us.” White disclaimed credit, attributing it to an unnamed source.

Is It a Chinese Proverb?

No, there is no evidence linking it to ancient Chinese wisdom. The “Chinese proverb” label first appeared in a 1985 Nebraska newspaper article about water expert Maurice Kremer, who repeated a version of it. By the early 2000s, it was falsely tied to Confucius in viral emails and articles. Native Chinese speakers and linguists have confirmed no equivalent proverb exists in classical or modern Chinese texts.

Related ideas about long-term planting date back further. For instance, a 1868 piece in London’s The Pall Mall Gazette noted: “Blessed is he who plants trees under whose shade he will never sit.” Partial matches (e.g., “the best time to do X was Y years ago; the next best is now”) appeared in U.S. newspapers as early as 1881 (for strawberry plants), 1902 (for transplanting trees), and 1913 (for urban planning).

We’ve all heard this nugget before. But in pharma, it’s not just a vague aphorism. It’s a guide to survival in an industry where timelines stretch: 10-15 years from bench to blockbuster, with most bets wilting before they bear fruit. Fast-forward to today, October 2025, and that “20 years ago” feels painfully literal. We’re staring at one of the biggest patent cliffs in decades, with heavyweights like Merck’s Keytruda (pembrolizumab, at $25B+ annually), Novo Nordisk’s Ozempic, and Bristol Myers Squibb’s Eliquis all losing U.S. exclusivity this year. AstraZeneca’s Lynparza joins the fray, alongside Novartis’s Xolair - collectively threatening up to 62% revenue drops for some giants as generics and biosimilars swarm in.

It’s not hyperbole: Analysts suggest this cliff as the most financially impactful since the early 2010s, with 65+ high-value patents expiring and biosimilar competition poised to slash prices by 30-50% overnight. The knee-jerk? Panic-buy M&A, slash R&D, or double down on the next “me-too” molecule.

But, what if we flipped the script? What if this cliff isn’t a chasm - it’s fertile soil? In the spirit of asymmetric learning, let’s reframe it as an optionality gold rush.

The real leverage isn’t defending, or wishing for, yesterday’s trees; it’s planting an orchard of latent possibilities today - in early phases, where costs are low and branches can sprawl across indications, geographies, and tech stacks. Done right, these “dormant seeds” could yield asymmetric payoffs 20-30 years from now, turning cliff-induced erosion into exponential growth.

Enter The Optionality Orchard: A framework for engineering long-term wins from preclinical and Phase I/II pipelines. It’s not about scattershot gambling; it’s deliberate cultivation - modular designs, IP ‘webs’, and data troves that keep doors open for pivots. Below are five tactics, each with a how-to and a nod to why they thrive in cliffs like 2025’s.

1. Modular Trials: Test Multiple Branches in One Trunk

Why it works: Early phases are cheap (under $50M vs. $2B+ for late-stage), so why tunnel-vision on one indication? Modular designs let you layer endpoints - like biomarkers for oncology and rare diseases - unlocking repurposing lanes without full reruns. In a cliff year, this hedges against single-asset flops, much like how early mRNA work (1960s discovery, 1980s nanoparticle tweaks) branched from cancer to COVID vaccines over 60 years.

How-to: In Phase I, build adaptive protocols with optional cohorts (e.g., via FDA’s MASTER protocol). Collect broad omics data upfront.

Example: A small biotech I know “modularized” a CNS candidate in 2023, adding psych endpoints that now tee up a depression pivot - perfect for post-Eliquis cardio-adjacent plays.

Asymmetric edge: 3x faster indication expansion.

2. Geo-Hedging: File and Forage Globally from Day Zero

Why it works: U.S.-centric filings miss 80% of the world’s patients - and regulations. Early global dossiers (e.g., Japan/EU first) generate diverse data sets for later tweaks, turning one drug into region-specific variants. With 2025’s cliff hitting U.S. exclusivities hardest, geo-hedging exports your orchard: Think thalidomide’s 1950s sedative flop morphing into a 1998 myeloma staple via international off-label trials.

How-to: Provisional patents in CTAs cover analogs for Asia/EU; run parallel tox studies for local endpoints. Novartis is already doing this with Xolair’s 2025 expiry - pushing inhalation variants in Europe to extend the canopy.

Asymmetric edge: Access to untapped markets like India’s $50B generics boom, buying 5-7 years of optionality.

3. IP Webs: Spin Provisional Patents into a Safety Net

Why it works: Patents aren’t monoliths; they’re webs. Early provisional patent applications on formulations, combos, or biomarkers create “evergreen” layers that outlast core expiry. Amid Keytruda’s 2025 tumble (Merck’s bracing for $10B+ hits), IP turns cliffs into launchpads - e.g., statins’ 1970s fungal screens yielding combo patents that fueled a $20B class into the 2000s.

How-to: File “shell” patents quarterly on variants (e.g., nasal vs. IV delivery). Use AI tools like GreyB to map gaps.

Real time example: Post-Ozempic expiry, Novo’s early oral semaglutide IP web is already sprouting oral-oncology cousins.

Asymmetric edge: 20-30% revenue retention via lifecycle management, dodging the 62% cliff plunge.

4. Dormancy Protocols: Shelve Smart, Harvest Later

Why it works: 90% of early assets “fail” - but failure can be subjective. Dormancy means archiving data for revival when tech/reg landscapes shift (e.g., ketamine’s 1960s anesthetic shelved until 2019’s depression nod, 50 years later). In 2025’s squeeze, this revives “zombie” pipelines cheaply, offsetting Ozempic-like voids.

How-to: Tag failed leads with metadata (e.g., “high inflammation signal”) in a searchable vault. Re-scan annually with AI.

Example: Cumberland’s Sancuso (expiring 2025) has dormant anti-emetic analogs eyeing post-chemo supportive care.

Asymmetric edge: Repurposing can shave 6-7 years off development time.

5. AI Scouting: Mine Historical Data for Hidden Fruits

Why it works: Early datasets are goldmines, but siloed. AI unearths cross-indication signals, turning 20-year-old Phase I scraps into fresh bets. As Big Pharma faces Jakafi’s 2026 cliff (Incyte’s $3B earner), this scouts adjacencies - like RDKit-powered chemistry hunts reviving Bosulif’s 2025 expiry kin for new kinase targets.

How-to: Feed legacy trial data into tools like PySCF or BioPython for pattern-matching. Partner with academia for unbiased scans.

Asymmetric edge: Spots 2-3x more opportunities than humans, accelerating from “shelved” to “scaled” in months.

This isn’t theory - it’s the orchard in action. mRNA’s 60-year arc? A triumph of optionality: Early modularity and dormancy turned a fringe RNA play into a $100B pandemic savior. Thalidomide? Geo-hedged revival from crisis to cure. And statins? IP webs that branched a class.

In 2025, as the cliff crumbles under Keytruda and others, these tactics aren’t defensive - they’re offensive. They’re how you plant not just for tomorrow’s quarter, but for 2055’s breakthroughs. Pharma’s patent “crisis” seems more like an invitation to asymmetric mastery…