Parrots or Pirates, redux

I wrote the original in August 2021 after a late-night Wikipedia spiral on pirate democracy, a misheard conversation (“Did you say pirates or parrots?”) and too many books about salt, feathers and pencils.

One of my favourite books remains Steven Johnson’s Enemy of All Mankind, which taught me more than I ever imagined could be true about pirates…

Four years later, the core still stands, but the edges are now sharp from real-world proof, bruises and the occasional triumph. I presume you know that we have a way to operationalise more asymmetric, more agile planning in early phase, so I’ll leave that out…

Here is the rewrite – the same soul, updated by everything I’ve learned since.

We still prefer parrots.

We say we want innovation, agility, boldness. But, we reward repetition, alignment, and not rocking the boat.

Kings once preferred obedient naval officers who (they thought) would sail in neat lines and salute on cue. They tolerated pirates only when the treasure was already in the hold and the danger had passed.

Nothing has changed except the uniforms.

Most pharma companies (most companies, most industries) are built for parrots:

Echo the strategy deck

Repeat the three priorities

Never contradict the room

Stay in formation

Pirates, meanwhile, still do what they did in 1718:

Elect (and depose) their captains - their democracy was a genuine surprise to me

Split the loot fairly or mutiny

Take lunatic risks because the upside is asymmetric

Learn brutally fast from every raid that fails

Five years of writing this Substack has only made the divide between the two in our industry clearer.

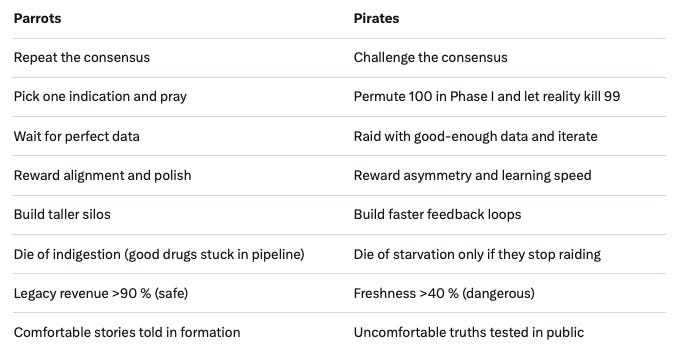

Here are the asymmetries that turned the original post from provocation into an operating manual.

The $30 bn asymmetry (2020 → still there in 2025)

The PD-1 decisions of the mid-2000s were there for everyone. Same data. Same journals. Same molecules. Different decisions.

One company permuted 20+ indications in Phase I and built an empire. Others played one-ship Battleship and are still explaining the miss to analysts. Lesson burned in: Parrots pick one story and repeat it. Pirates run the 100-option spreadsheet and let the data kill 95 of them early.The Freshness asymmetry (2025 Index)

J&J: >95 % of revenue from molecules launched before most of its staff were born. Lilly: ~40 % from launches <5 years old. Same industry. Same regulators. Same talent pool.One has been a parrot fleet sailing in circles. The other is a pirate armada raiding new oceans every season.

The AI asymmetry (2024’s Al I experiment)

Good AI is a pirate intern: it “what-ifs” you to death until something asymmetric survives.

Bad AI is the ultimate parrot: it gives you 2,000 polished words that say exactly what you already believed.The China asymmetry (November 2025)

China is running the pirate playbook at nation-state scale:Massive patient pools = faster feedback loops

Regulatory speed = shorter raids

State treasure backing the long-shots

We respond with tariffs and PowerPoint. They respond with 28 % of our own pipeline licences now coming from Shanghai and Suzhou. Check here this weekend for a breakthrough Index for the Chinese landscape…

The Teva Rise asymmetry (November 2025)

A generics giant begging the world: “Send us your pirates, we’ll give them a ship and a letter of marque.”

Translation: even the most parrot-like company on earth now knows internal R&D alone breeds monoculture.The personal asymmetry (the one that hurts the most)

I still catch myself parroting. Writing these posts remains the only discipline brutal enough to expose it. As I said in the retrospective last week:“I write these posts partly to provoke you, but mostly to provoke myself.

If I can’t explain it clearly enough to hit publish, I probably don’t understand it well enough to bet a pipeline on it.

Five years and 270+ posts later, the biggest payoff hasn’t been the readership; it’s been the merciless mirror that writing holds up to my own thinking.”

So here is the 2025 update:

Choose your ship.

Most companies still choose the parrot fleet because it feels safe right up until the moment it sinks. The pirates are messy, loud, occasionally wrong, and impossible to control. They also keep winning.

You have three moves:

Start squawking louder (career suicide)

Quietly build a pirate crews inside the machine (career judo)

Jump ship and join one that already flies the black flag

There are more of the third kind than there were in 2021.

The Lilly bit

I called out Eli Lilly as the standout pirate armada in Big Pharma: ~40% of revenue from launches less than five years old, versus J&J’s >95% legacy drag. It’s not luck - it’s a deliberate cultural and strategic mutiny against the parrot monoculture that sinks most pipelines. Lilly doesn’t just tolerate pirates; they crew the ship with them.

Drawing from my January 2025 piece about Lilly’s CEO Dan Skovronsky in The Large and the Agile, plus their blistering 2025 run (Q3 revenue up 36% to $11.1B, raised full-year guidance to $58-61B ), here’s the expanded playbook. These aren’t generic “innovation” slides - they’re approaches to uncertainty, permutation hacks, and feedback loops that make Lilly the asymmetric envy of the industry. Parrots polish the deck; Lilly’s pirates seize the wheel.

1. Delegated Boards: Empower Misfit Crews, Not Consensus Committees

Pirates elect (and depose) captains mid-raid - democracy born of survival, not HR policy. Lilly mirrors this with decentralized governance boards: Small, cross-functional teams with real decision rights, bypassing the usual C-suite logjam. Dan Skovronsky described it as “biotech speed in a Big Pharma body” - no more waiting for 50-slide approvals.

2025 Proof: This fueled the rapid pivot to obesity cascades, where tirzepatide (Mounjaro/Zepbound) disrupted not just diabetes but a $100B+ market. Q1 2025 saw 60% more doses shipped vs. the prior year, capturing a 53% obesity share. Without delegated autonomy, they’d still be parroting Phase II data.

Pirate Edge: Asymmetry via speed. Permute 100 indications early (echoing What if You’re Wrong?), kill 99 via crew votes, launch the survivor. Result? Kisunla (donanemab) approved in US, Japan, UK, and China for Alzheimer’s - Lilly’s first amyloid plaque therapy, raiding a $15B neuro landmass.

“We don’t run decisions through a central filter that slows everything down. Our teams have skin in the game - they own the risks and the raids.”

(The Large and the Agile, riffing on Dan Skovronsky: Delegated boards as “the secret to our freshness.”)

2. Open Innovation Platforms: Raid the High Seas for External Pirates

No self-respecting pirate sails solo - they press-gang talent from every port. Lilly’s Open Innovation Drug Discovery (OIDD) platform, launched pre-2021 but turbocharged in 2025, invites academics and startups to submit early-stage compounds for co-development. It’s low-cost permutation: Screen thousands, iterate the winners, split the treasure.

2025 Raids: Over $3B in January deals alone - e.g., Alchemab for ALS antibodies ($687M milestones), Verve Therapeutics acquisition for gene-editing in CVD. Juvena Therapeutics partnership for muscle health via stem-cell tech, diversifying beyond GLP-1s (now 70% revenue risk if unchecked) . Plus, a $250M BigHat Biosciences tie-up for AI antibody engineering.

Pirate Edge: Brutal learning loops. External pirates bring “what ifs” Lilly’s internal parrots might miss - e.g., OIDD expanded to tropical diseases like malaria, raiding unmet needs without bloating the $11B R&D budget (22% of revenue, up 27% YoY) . Ties to Parrots or Pirates: “Tolerate the pirates... or stay tethered.”

“Open platforms aren’t charity - they’re our garage for invention’s playground. We get 1,000 ideas, test 100, launch 10. The rest? Fast failures, no ego.”

(Remix from Bell Labs, applied to Lilly’s OIDD: External crews as the anti-monoculture.)

3. AI as Pirate Intern: Witty Permutations, Not Polished Echoes

Pirates learn from every botched raid - AI at Lilly does the same, but faster. After they appointed their first Chief AI Officer in 2025 (Thomas J. Fuchs), they’re deploying agents across discovery, trials, and ops: Quantum chemistry for oligo optimization (Creyon collab), digital twins for manufacturing . The Hyderabad hub focuses on AI/automation for end-to-end pipelines.

2025 Proof: AI slashed trial design time for oncology assets like imlunestrant and olomorasib (Phase 3 data at ASCO 2025). In incretins, it permuted delivery hacks (e.g., oral semaglutide), boosting Q3 pipeline momentum.

Pirate Edge: As in Al I, AI exposes “sloppy prompts” (lazy thinking) - Lilly uses it to iterate with humour and depth, not just crunch data. Asymmetric: While parrots feed it consensus, pirates prompt “what ifs” for 30% faster discovery.

“AI isn’t the oracle - it’s the intern who calls out your bad map. At Lilly, we let it redraw the route mid-raid.”

(Al I remix, via Thomas Fuchs: AI agents as “co-pirates” in the engine room.)

4. Mega-Investments in Garages: Reshore the Raids, Scale the Spoils

Pirates need fast ships - Lilly’s building a fleet with $40B+ in U.S. manufacturing (LEAP district in Indiana: $13B for foundry and sites; expansions in VA, TX, Puerto Rico) . It marries Trump-era tailwinds (tariffs, reshoring) with pirate pragmatism: Own the supply chain to raid without bottlenecks - we all remember the manufacturing issues that hurt Novo in this market.

2025 Proof: Doubled incretin doses in H1, hitting 32% YoY growth despite GLP-1 saturation . Enables “diverse trials reflecting our world,” per their mission - patient-centric raids on access barriers .

Pirate Edge: Feedback from production loops back to R&D—e.g., AI-optimized injectables for oncology . No more parrot delays from global chokepoints (hello, China scars).

“We invest in garages so our playgrounds don’t gather dust. $27B in U.S. sites? That’s fuel for the next 40% freshness raid.”

(Bell Labs echo, tied to Lilly’s infrastructure: Build to iterate, not hoard.)

The $30bn Lesson: Why Lilly’s Pirates Are Rewriting Pharma’s Map

Back to the asymmetry: Lilly’s not just fresh - they’re asymmetric because they learn asymmetrically. While parrots repeat “one-ship” bets (c.f. PD-1 flops), Lilly’s crews raid with data, depose bad captains, and split spoils fairly (diverse trials, affordable access). 2025’s momentum? Phase 3 readouts in breast cancer, immunology, and a pipeline that’s 60% externally-sourced. Dan Skovronsky nailed it: “We’re large, but we move like the agile.”

I would be interested in understanding how much autonomy Lilly management grants the Project teams in terms of decision making (go/no go etc). What is the size of the blank cheque? There is always tension between the centre (corporate management) and the periphery (the BUs). This can be healthy or occasionally toxic, but it feels like Lilly has been a certain equilibrium between the two. My other thought is that Lilly has benefitted from its location (plus state law) which has effectively insulated it from acquisition during its leaner times (many years ago: In 1990 it was worth a mere $16bn if my maths is correct). this has anabled the company to think genuinely long-term unlike many of its big pharma peers.